The Commission just published an interesting analysis of a set of large-scale EU business surveys. The results highlight challenges that businesses face across the Single Market, ranging from high energy prices to regulatory burdens. I discuss some of the highlights here.

The findings support the Commission’s new focus on competitiveness. A comparison with earlier survey data reveals a sharp dropoff in EU manufacturing firms’ (self-perceived) international competitiveness. Energy prices, access to financing, and the weight of business regulation are cited as major impediments to business activity.

Let’s see whether the upcoming Clean Industrial Deal (to boost competitiveness and make energy affordable) and first omnibus simplification proposals (aiming at reducing the regulatory burden) are ambitious enough to start improving the business outlook.

1. Energy cost

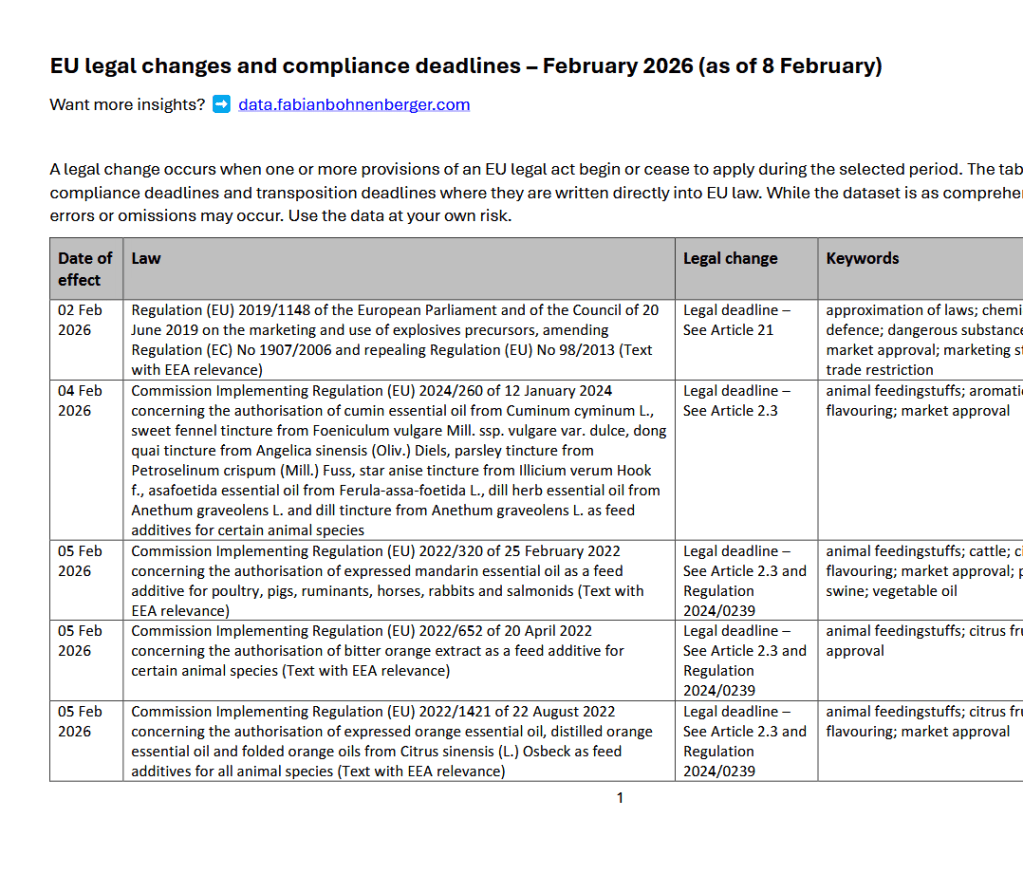

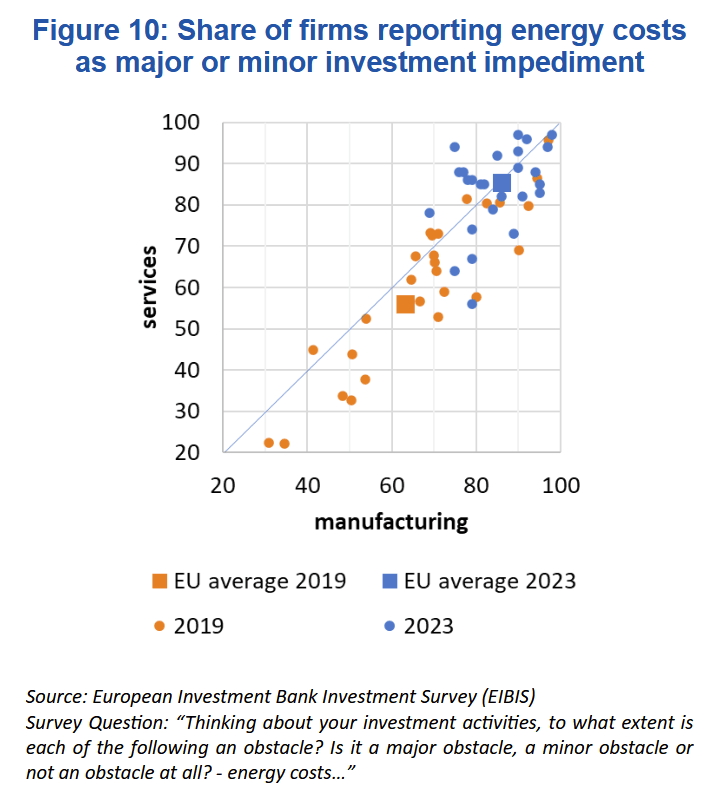

The surveys reveal a dramatic increase in the share of EU businesses feeling constrained by energy cost. Even in the Member States with the lowest energy prices, more than 60% of companies perceive them as an obstacle. And this applies to both services and manufacturing. The figure comparing results with 2019 looks scary, see below.

2. Availability of finance

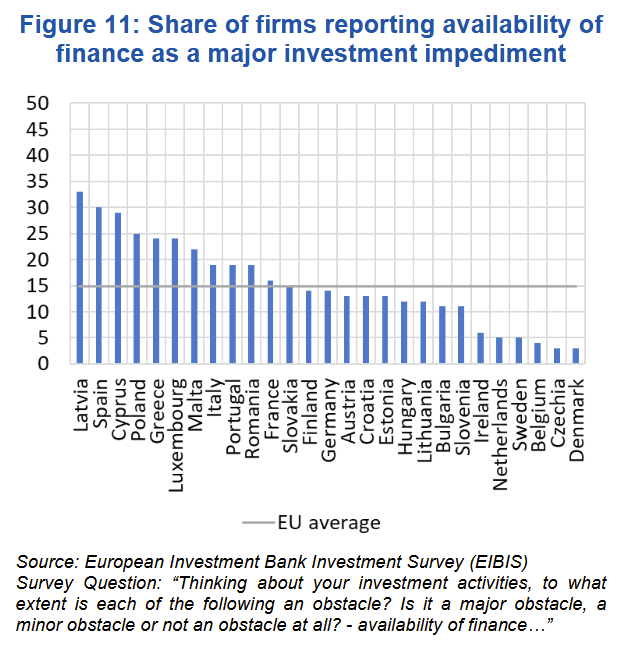

Depending on the country, access to finance can be an obstacle for more than a quarter of all companies (Latvia, Spain, Cyprus, Poland). The EU average for businesses feeling constrained by access to financing is about 15%.

3. Business regulation

The impact of business regulations is cited by 26% of all EU companies as a major investment impediment. According to DG GROW’s analysis, larger dispersion of results across Members States (more than 45% in Spain and Portugal vs less than 5% in Czechia and Denmark) highlight the role of national (on top of EU level) regulation, as well as the different degrees of digitisation of public administration.

4. Impact of obstacles on companies’ (self-perceived) competitive position:

A comparison with data from previous years shows that firms in 11 Member States perceive a significant deterioration of their international competitiveness.

Germany and Austria stand out with particularly pronounced losses, but are by no means the only examples. (See figure below)

About 60% of the competitive erosion occurred as a result of the 2022 energy shock. But the four most battered sub-sectors include both energy-intensive industries (basic metals, chemicals) and others (manufacturing of electrical equipment, automotive industry). This signals that faltering competitiveness can only be partly attributed to higher energy prices.

See the full results, with more data and analysis, here: Obstacles to economic activity in the EU – Publications Office of the EU