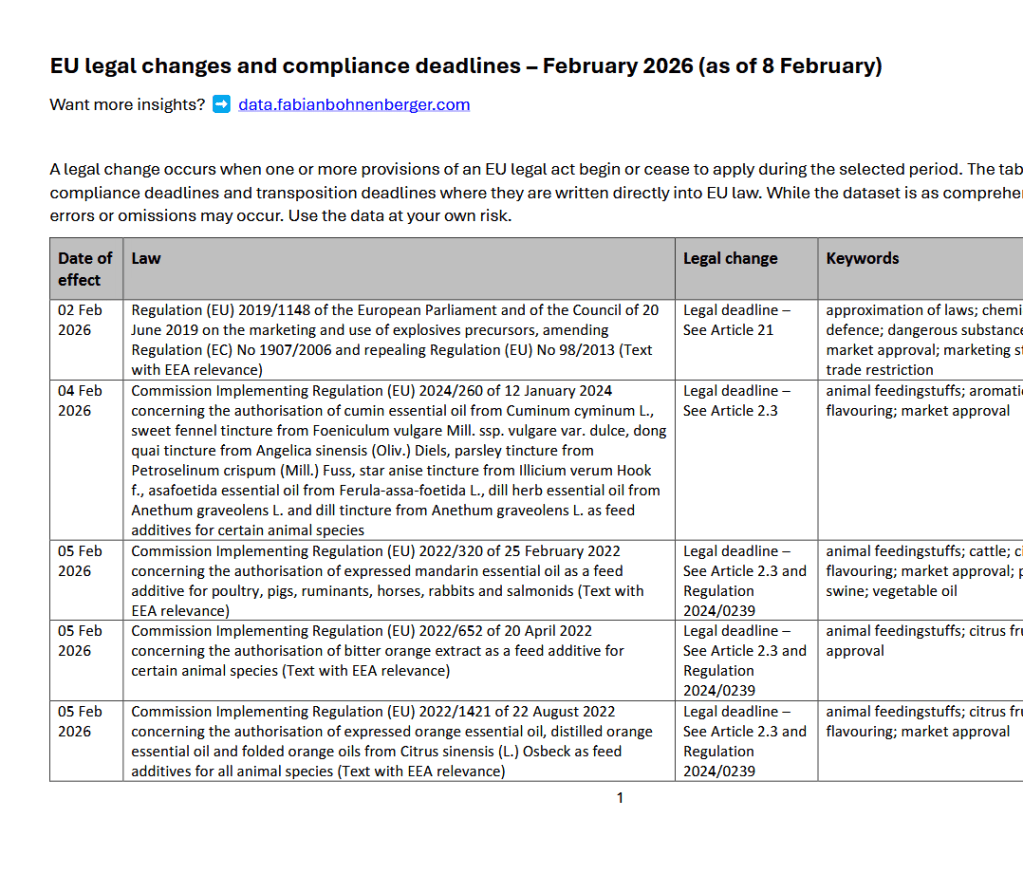

The US decision to increase tariffs on China puts additional pressure on the EU to take similar action – but there is the risk of Chinese retaliation.

Following up on my overview of ongoing EU investigations into China’s coercive and unfair trade practices, here is an update on recent developments and next steps for the EU.

EU trade defence might purposefully project the air of a boring bureaucratic exercise, but US actions and likely Chinese reactions suggest that we cannot ignore the bigger (geo)political picture.

1. US tariffs against China

On 14 May the US government decided to maintain Trump-era tariffs against China and increase them on key products. Higher tariffs will apply to strategic imports like electric vehicles (EVs) and their batteries, semiconductors, critical minerals, solar cells and some medical equipment.

The decision reflects economic and national security concerns, but also has a clear political rationale. It allows President Biden to portray himself as tough on China and protector of US manufacturing jobs in the run up to the US elections in November.

The US administration’s motives clearly vary across the individual products. Increasing tariffs on EVs to 100% (plus a 2.5% MFN tariff) appears in large part symbolic. The existing tariff of 27.5% and other consumer incentives for US cars already limit EV imports from China. However, showing how big the competitiveness gap is, imports of the cheapest Chinese models could still be worth it. By contrast, duties on semiconductors are mostly driven by national security concerns. The US is aiming to keep its chip supply out of China’s hands.

The US tariffs increase the pressure on the EU to respond to China, but also offer political cover for a tougher EU response – at least the US seems to be hoping that it does. US Treasury secretary Janet Yellen recently urged EU policy-makers to join the US in responding “strategically and in a united way” to China’s industrial policy.

2. EU anti-subsidy probe into Chinese EVs

The EU remains more cautious in its approach and, unlike the US, has followed the WTO rulebook. As a result, the EU imposed additional duties only where it has found clear evidence of state subsidies or dumping.

In addition, WTO rules constrain the European Commission in how much pain it can inflict on Chinese manufacturers – even if these do not cooperate with the EU’s investigation. This stands in stark contrast to the high US tariff top-ups.

These legal constraints are a problem for the EU insofar as most Chinese EV manufacturers enjoy substantial profit margins in Europe. If the countervailing duties are not high enough, they won’t slow market share gains for Chinese automakers.

Duties of 40-50% or higher would likely be necessary to make the European market unattractive for Chinese EV exporters, according to the Rhodium Group. However, actual duties could be in the 15-30% range.

Not shutting the door completely might actually be necessary to achieve the EU’s ambitious climate goals. For example, the EU’s decision to ban new cars with combustion engines from 2035 will also mean higher EV demand.

The Commission has to announce provisional duties on imports by 4 July and will likely do so earlier. The duties can apply retroactively (up to 90 days) because EU customs authorities are already required to “register” EV imports.

3. Chinese retaliation

In response, China is reportedly mulling slapping 25% tariffs on imported cars with large engines. While this is also not taking WTO rules seriously, it should not come as a surprise – German luxury car-makers have long warned about their dependency on China, some ironically for both manufacturing and sales.

President Macron’s recent pleas with his Chinese counterpart Xi also didn’t alleviate the concerns of French luxury cognac brands, which fear retaliation in a parallel Chinese anti-dumping probe.

4. More EU anti-dumping investigations

Xi’s trip to Europe in early May also seems to have done little to reassure EU officials about China’s trade practices.

Since his visit, the Commission has launched five (!) new anti-dumping investigations against China, covering tin plate, wood flooring, seamless tubes and pipes, lysine, and vanillin.

5. EU trade enforcement doctrine

Given this flurry of activity, a priority for the next Trade Commissioner will be to develop a “coherent doctrine” for the use of the EU’s autonomous tools, according to DG Trade boss Sabine Weyand.

While the Commission has started to test its growing arsenal of trade enforcement tools against China (see my overview here), more work is needed to make these coherent and effective.

Developing this playbook takes more than improving coordination across the Commission services (not all tools are controlled by the Trade Commissioner).

To be truly useful, the doctrine requires tough conversations with Member States about their willingness to confront China, which remains a key export market and manufacturing hub. The EU will also have to decide to what extent it wants to act in concert with the US and other partners – although this conversation will likely have to wait until after this year’s elections.